To stop investment fraud, you need to understand it.

What’s lurking behind those smiles and their smooth sales pitch? Fraudsters follow a series of steps that are easy to identify. Knowing the playbook will help you see what’s under the surface.

Below is a quick look at the seven steps that take you inside the mind of a scammer and their schemes. To take a deeper dive into the steps download the full guide here:

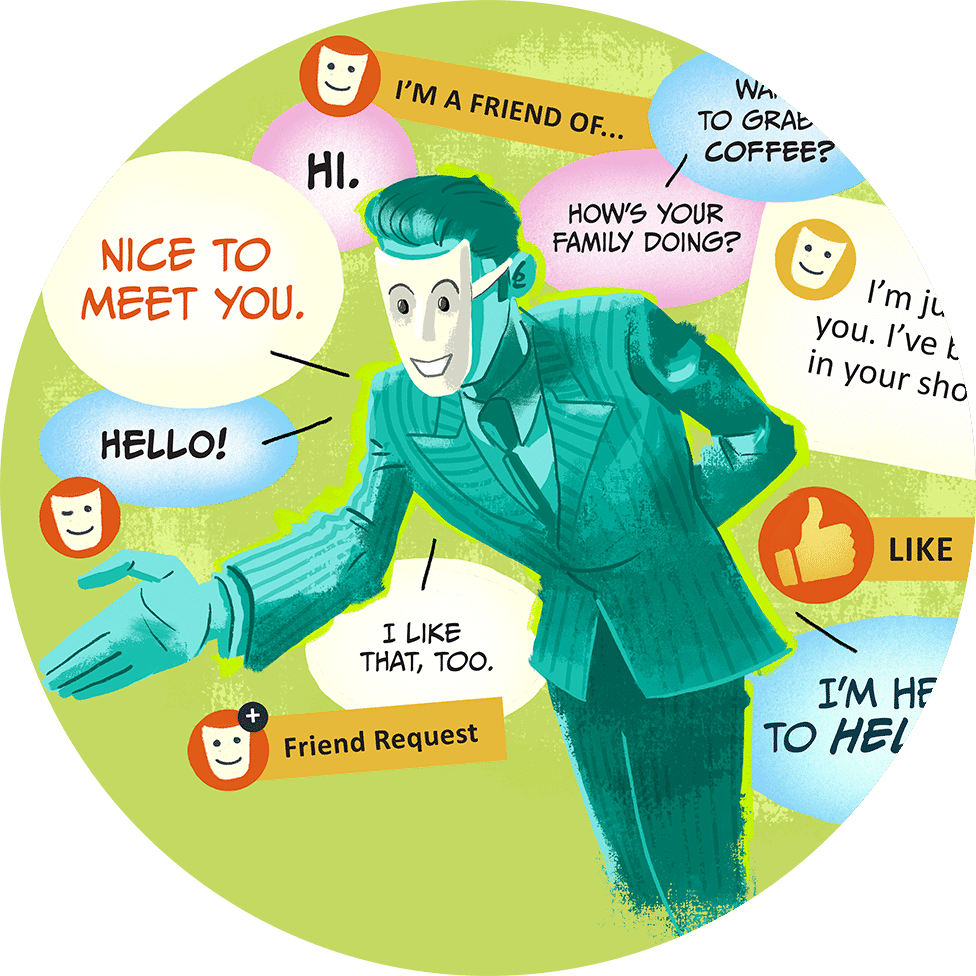

1

Identify potential victim(s) for the scam

What THEY do:

Start communicating, including using family and friends.

What YOU can do:

Be wary of someone who gets too close too quickly.

2

Befriend and earn trust

What THEY do:

Provide advice to establish reputation as a reliable authority.

What YOU can do:

Don’t automatically trust a new acquaintance that comes through a friend, family member or community.

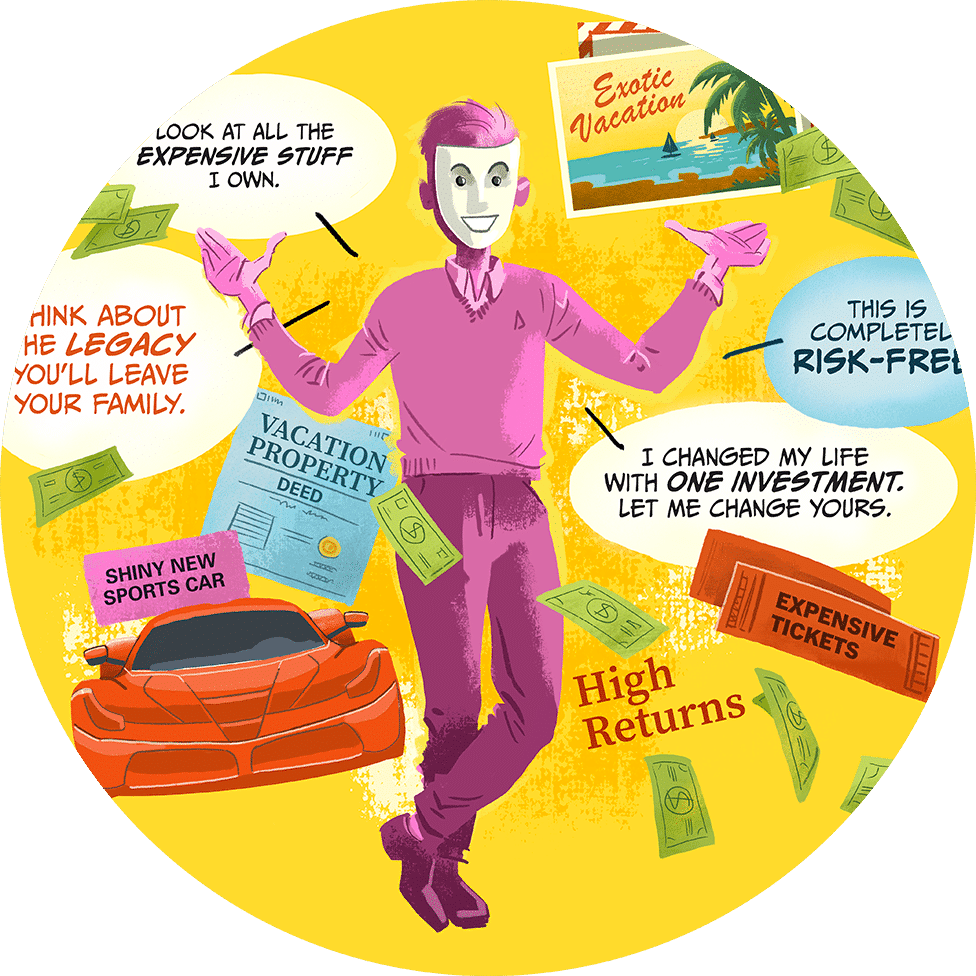

3

Drop hints or showcase the benefit of an “investment” opportunity

What THEY do:

Flaunt wealth and success while frequently talking about how it was achieved.

What YOU can do:

Don’t let the promise of wealth impress you — it may not be real, or funded by money stolen from others.

4

Offer the potential investment opportunity

What THEY do:

Create a sense of urgency or intimacy to make the offer more attractive.

What YOU can do:

Always do your own research, no matter who recommends the investment, and don’t be rushed into any investment.

5

Receive money for the investment

What THEY do:

Frequently communicate with the potential target and respond quickly until money is handed over.

What YOU can do:

Don’t invest until you have done your research, have satisfactory answers to all your questions and fully understand the opportunity.

6

Disappear (the Ghosting Act)

What THEY do:

Reassure that money will be available at a later date, then ignore the target and stop responding to inquiries.

What YOU can do:

Contact the ASC right away if you suspect something is not right — don’t isolate yourself. Reach out for support.

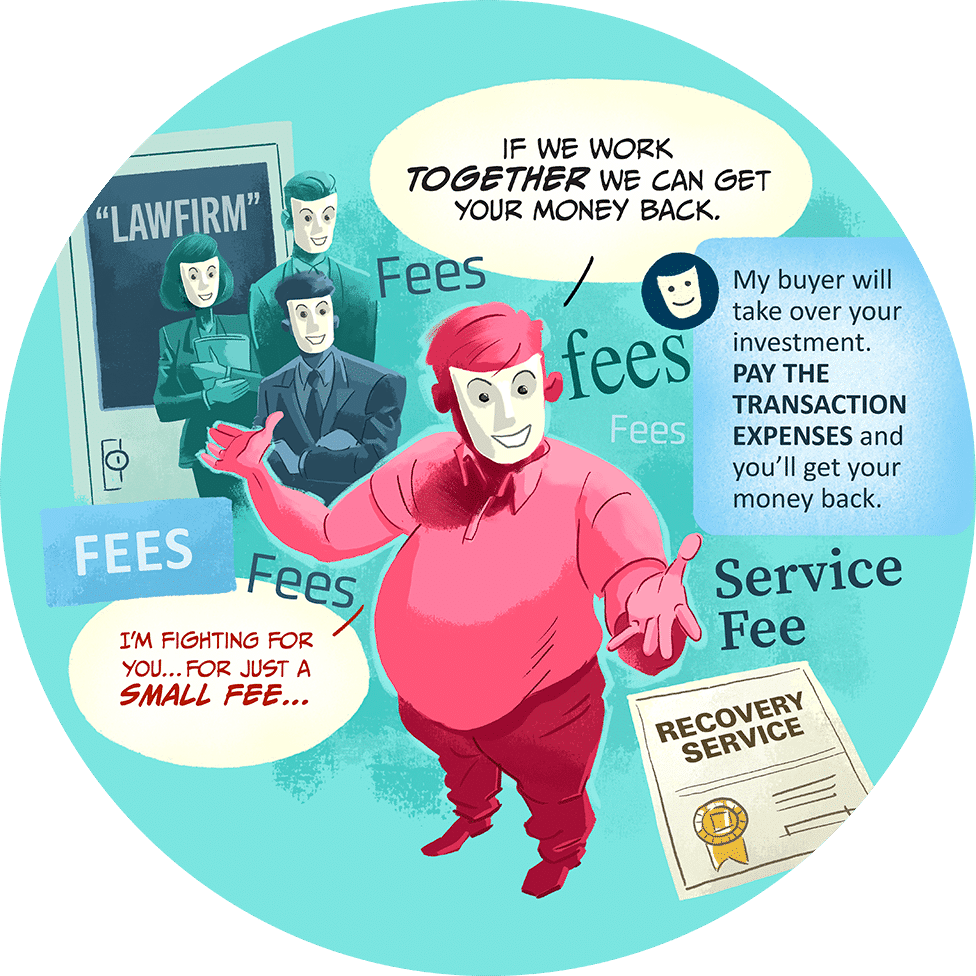

7

Target the victim again (the Recovery Act)

What THEY do:

Contact the victim and offer to reclaim the investment for a fee. Then disappear again.

What YOU can do:

Don’t be fooled by recovery agencies or individuals who contact you saying they can recover your money for a fee.

Knowledge is power

If you understand these steps, you’ll be able to recognize and avoid scams and be able to take action no matter the situation you find yourself in. Remember:

- No one cares more about your money than you.

- Anyone can be a target.

- Identify. Avoid. Prevent.

- Report it!

Part of a healthy financial future means doing your research and taking care of your money. Make sure you Increase your knowledge about finance, investments and how to manage your money through every stage of your life.

Take the quiz

Now that you’ve started to understand the steps and what you can do to avoid fraudsters’ tactics, why not take a quick quiz and test yourself. You might be surprised at what you find out!

See the full playbook

Want to learn more? Discover the steps fraudsters rely on and learn how to help your friends, family and yourself stay clear from investment fraud. Download the full guide below:

We’re here to help

If you feel you or someone you know has been offered a suspicious investment or may be a victim of investment fraud, don’t hesitate to contact the Alberta Securities Commission.